Suspicious Transactions and Orders Research Kit

GPW STORK is a web application that optimizes the process of analysing market data in terms of detecting market abuse. Specifically the area of detecting cases of manipulation and the use of insider information referred to in the MAR regulation.

Modules

The application has been developed based on the expert knowledge and experience of the GPW Market Surveillance team. The application uses a number of technologies to maximize the efficient and effective use of available data.

Alerts Module

|

|

|

||

|

Based on predefined formulas, they signal unusual or suspicious behaviour of the instrument and / or the investor in the previous session. Alert parameters can be modified by the user. Alerts are generated automatically and if necessary also at the user’s request (e.g. to assess the impact of changes in parameterization on the scope of the generated results). |

Currently as part of the application, there is one price alert and volume alert presenting and constantly updating the ranking of instruments with a high degree of atypical behaviour of the price and / or volume in the current session in relation to their typical behaviour, together with an indication of the dominant client. |

The application allows you to optionally include in the analysis also other types of alerts calculated separately on the user’s side (e.g. alerts generated in a different environment or created using a different programming language) in order for this to function efficiently and conveniently analyse the results directly within the application. Thus, this functionality provides the user with “extensibility” of using the application also for non-standard types of alerted events. |

||

Analytics Module

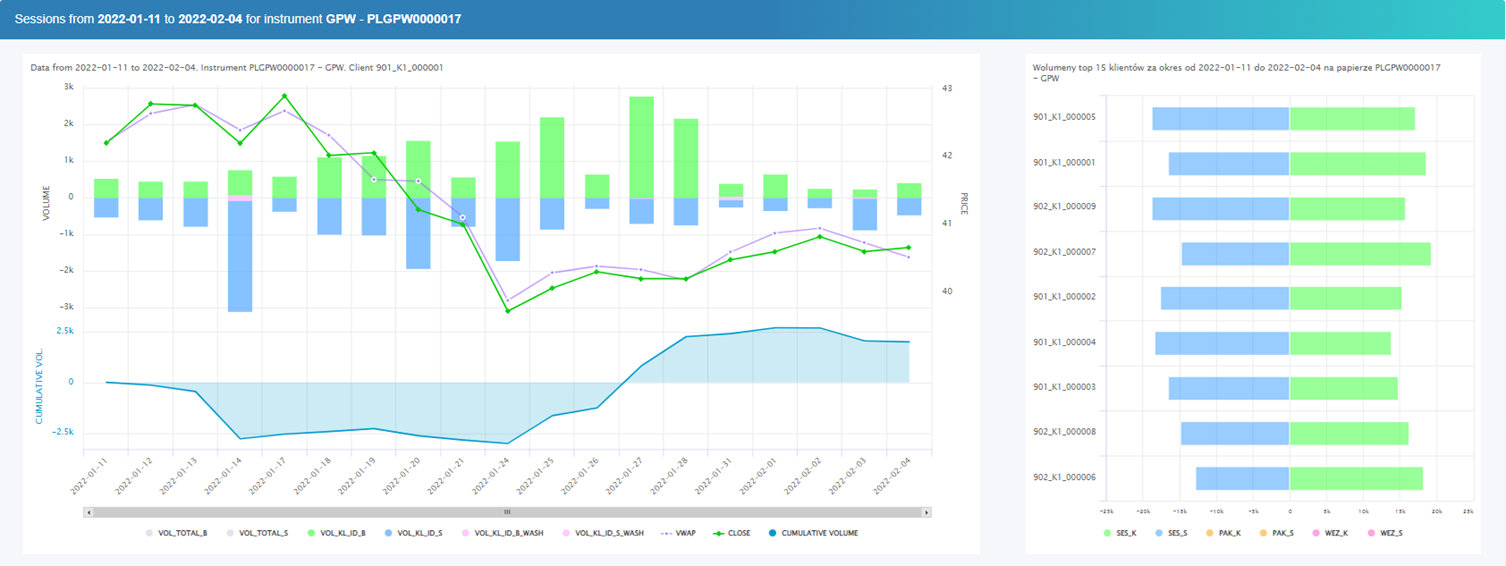

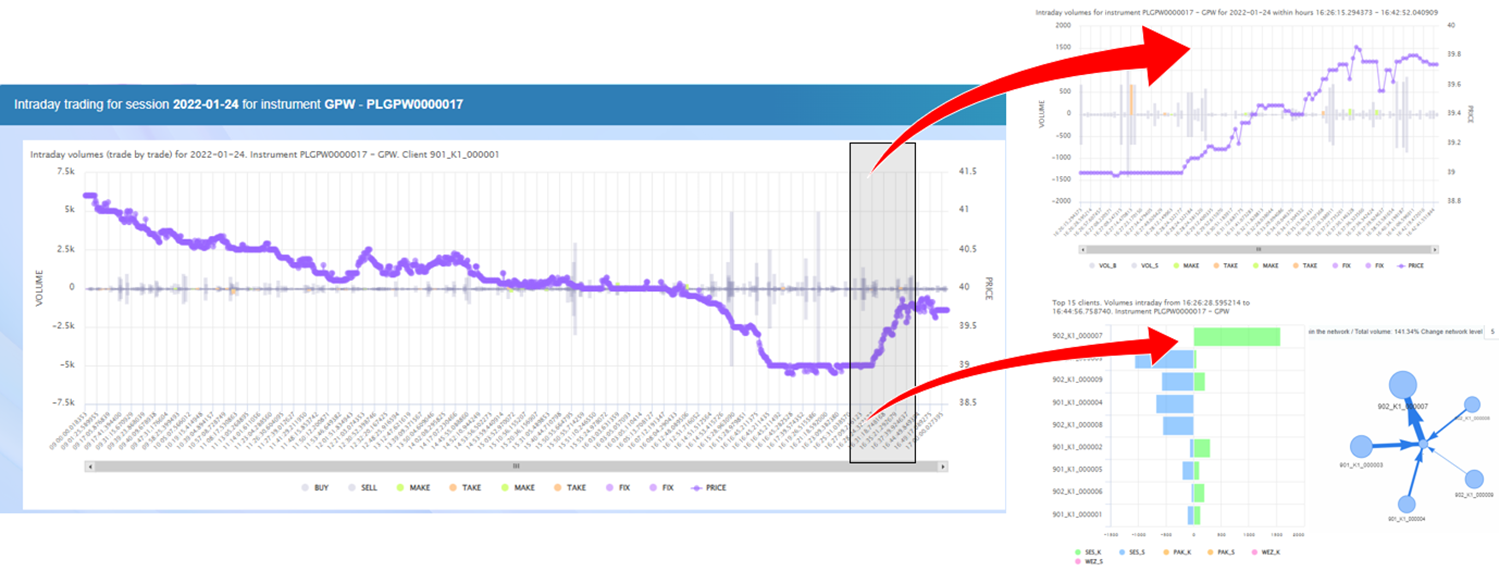

- visualization and analysis of the supply and demand structure as well as investors’ transaction activity, this is shown on both a daily and intraday basis (single-session), taking into account block trades

- the possibility of easy “zooming in” on a particular period from the level of the price chart, enabling quick automatic recalculation of charts and statistics for a selected period

- visualization of the general characteristics of the client on a given instrument - based on current transactions along with information on the number of transactions conducted in the analyzed period representing new highs and lows of the trend

Summary

- The application enables efficient analysis of market data in a visually and functionally attractive form. As a result, it can quickly “track” potentially suspicious customers and efficiently analyse the entire scope of their investment activity, even when suspicious events occur in fractions of a second, also during the current session (data in real time).

- The application is a powerful analytical tool for detecting and comprehensively analysing these types of market events, regardless of their nature (manipulation / insider trading / others).

- The record keeping functionality of the application provides the ability to demonstrate the correct implementation of the obligation referred to in art. 16 MAR.

- The unique feature of the application is the speed of operation (querying the database), which enables user friendly work with this tool.

DISCLAIMER: Please note that all the above price, volume and time data are real and publicly available, whereas broker and client codes are completely artificial (fictitious), applied to individual trades randomly, and as such cannot be deemed to be real under any circumstances.